Businesses need to keep in mind that under federal law, a company is not required to hand out

pay stubs to its employees. However, there are several instances in an employee's day-to-day

life where he/she will need to show company proof of income documents for income verification

purposes.

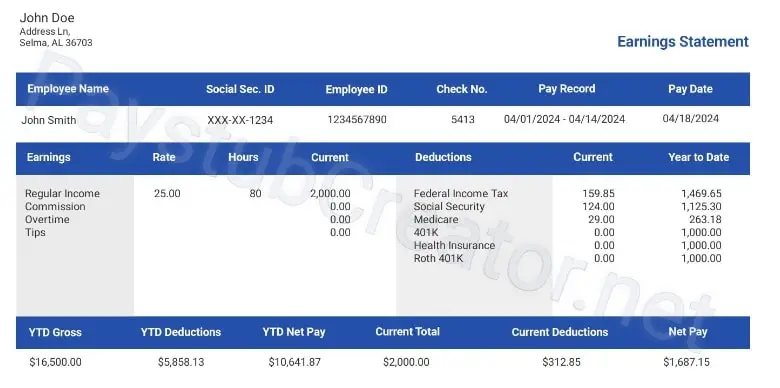

Having business pay stubs helps individuals verify that their gross wages, withholdings &

deductions are accurate. The calculation hassle can easily be solved with the help of a paystub

creator to solve your business needs.

Employees and individuals will need to show proof of income or simply use their pay stubs for

any of the below scenarios;

A Company Pay Stub For A Personal Loan:

If an employee is in need of getting a personal loan, some banks might request the most

recent company pay stub. Others might ask for a month or two worth of pay stubs to make sure

that they are employed and can repay the loan on time.

An Employee Pay Stub For Auto Loan:

The process of an employee applying for an auto loan is somewhat similar to taking out a

personal loan, wherein banks need to make sure that the individual can pay the loan back.

Depending on the amount the car will be financed at, they might require a certain figure per

month to be made by the employee.

They ask to see the pay stub and verify the proof of income to make sure that the employee

actually makes what he/she proclaims.

Employees:

Employees must always have pay stub documents to act as proof of income. Paycheck stubs are

helpful for income verification instances as well as to determine if the amount of taxes are

paid correctly. Not to mention, paystubs are always good to have when filling out tax forms.

In the case that a pay stub document is not present, a W-2 form can be used to calculate the

necessary information.

A Company Pay Stub For Taxes:

Having company pay stubs on hand can make tax filing season much easier at the beginning of

the year for both the employer as well as the employee. Pay stubs reflect just how much

income was received by an employee and how much were the taxes paid. Pay stubs also stand as

proof of certain benefits attained by the employee.

An Employee Pay Stub For Rent:

Landlords or real estate agents will often ask for employee pay stubs to make sure that

the individual asking to rent, can afford timely payments without delay. Some complexes

or rental agencies will require several weeks' worth of paystubs or pay stubs online.

Find out more about how

a renter can show proof of income or an employee can

also

create pay stubs online.

A Company Pay Stub For Business Related Accident

Compensation:

In the unfortunate event that one of your company employees stumbles upon an accident

while performing his/her job duties, paystubs come in handy here. If an employee files

for compensation, then you need to

look at their pay stub to understand their

earnings and how much to compensate them.

If you still need more clarification on why a company paystub is important or what is the

point of using a paystub generator for your company, simply check

out this

article.

Our customer support is available 24/7:

Our customer support is available 24/7: