Pay Stub Abbreviations. Everything You Need To Know To Understand Your Pay Stub

Most people can look back on the day they received their first paycheck. The first thing they noticed is that the amount wasn't as much as they expected. The next was their missing wages had gone. Seeing the deductions is a true reality check. Many of us just weren't taught about taxes, insurance, and other amounts that come out of our earnings.

Checks come with pay stub abbreviations but if the employee doesn't know what those initials and codes stand for it can be confusing. Some companies offer a mini-tutorial during new hire orientation that explains W-4's and 1099. Rarely do they go over, pay stub terminology. The same is true for online employee portals.

Having the information readily available to employees is a great tool. This is why some employers include codes ad their meanings on pay stubs. As companies move to paperless payroll and direct deposit, some employees may no longer know what's being deducted. Is your paycheck coming up short? Keep reading as we breakdown what those abbreviations stand for.

What Are Pay Stub Abbreviations?

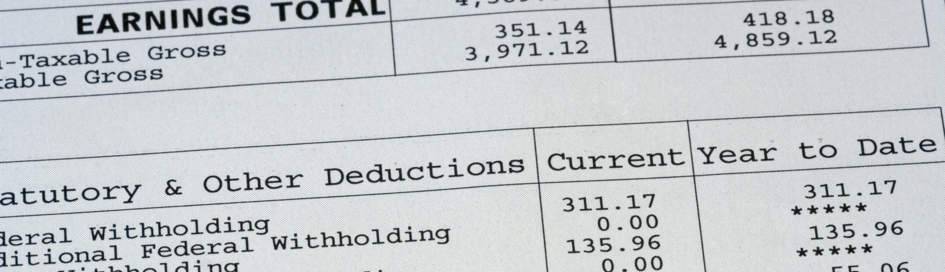

A pay stub abbreviation is a code or list of codes located on an employee's paystub. These abbreviations assist the employee in understanding how much they earned, deductions being taken out, and the amount they will take home. Following is a list of common pay stub terminology to assist you in understanding your paystub.

Below, we have created a paystub glossary to help you identify what the abbreviations mean, as well as categoroze them to make it easier.

Human Resources (Payroll and Employee management)

Payroll Schedule: The timeline for paying employees (weekly, bi-weekly, monthly).

Employee ID: A unique identifier assigned to each employee.

Benefits: Additional compensation, such as health insurance or retirement plans.

PTO - Paid Time Off: Paid time off is pay an employee receives for the time they were not working. This could be paid vacation time or sick time. Some employees give employees a lump sum of PTO at the start of the year. Others require employees to earn their PTO per pay period worked. There are times when the pay stub shows VAC or SICK.

GP Gross Pay: Gross Pay When you were hired the employer told you how much you would earn, either in hourly pay or a salary. Gross pay is the amount you earn each pay period prior to any deductions coming out of your check.

Net Pay: Net pay is the cousin of gross pay. This is the amount of your take-home pay after all deductions have been taken out of your earnings.

OT - Overtime: OT is the pay stub abbreviation for time worked over your regular hours. The law states that any time worked over 40 hours in a week, is subject to overtime pay. This is typically 1.5 times the amount of your hourly pay. Salaried employees are not entitled to overtime pay.

Garnish - Garnishment: No one wants to see this pay stub terminology appear on their pay stubs. This means that a state court or the federal government has placed a lien against your earnings to recover a debt. The most common garnishments are child support, student loans, and tax defaults.

Pay Period: The recurring schedule employers use to calculate pay.

Pay Stub: A document summarizing an employee’s earnings and deductions.

401(k) - Retirement Plan: A 401(K) is a common retirement plan offered through employers. Oftentimes the employer makes some form of matching contribution to the employee's retirement account if they choose to participate.

Finance (Budgeting and Financial Management)

YTD - Year-to-date: Year-to-date fields on pay stubs are the cumulative totals for amounts earned and deducted from your paycheck as the year progresses. The numbers reset each fiscal year.

Deductions: Amounts subtracted from gross pay for taxes, insurance, etc.

EIN - Employee Identification Number: The EIN is a government-issued number assigned to businesses in the United States. It is a nine-digit number assigned by the Internal Revenue Service. You may also see FEIN (Federal Employer Identification Number) or FTIN (Federal Ta Identification Number) on your pay stubs.

Financial Statement: A report summarizing a company’s financial performance.

Payroll Taxes: Taxes withheld from an employee’s earnings to fund government programs.

1099-K: A tax form reporting payments received via payment processors.

Direct Deposit: A method of electronically transferring pay to an employee’s bank account.

FICA - Federal Insurance Contributions Act: We've seen the memes on social media asking, who is FICA and where can I find him. FICA is money deducted from our paychecks to fund Social Security Retirement, Medicaid/Medicare and Supplemental Security Income.

Freelancers and Gig Workers (Independent Contractors)

Invoice: A document requesting payment for services rendered.

Write-Offs: Expenses deducted from taxable income.

1099-MISC: A tax form for reporting income earned as an independent contractor.

Self-Employment Tax: Taxes paid by freelancers for Social Security and Medicare.

Estimated Taxes: Quarterly tax payments made by freelancers.

Tax Deductions: Federal Taxes are deducted from every employee paycheck. When you're hired, you must complete a W-2 form. This form lets the employer know how many deductions you have. Your federal taxes are based on a percentage of your hourly pay or salary, calculated based on the number of deductions

Independent Contractor: A worker who provides services to a client without being employed.

Gig Economy: A labor market characterized by short-term contracts or freelance work.

W-9 Form: A form used to provide taxpayer identification information.

Business Expenses: Costs incurred while running a business or freelancing.

Tax-Related Terms

Taxable Income: The portion of income subject to taxation.

Withholding: Money taken out of an employee’s paycheck for taxes.

Filing Status: The category defining how an individual files their taxes (e.g., Single, Married).

W-2 Form: A tax form reporting an employee’s annual earnings and taxes withheld.

AGI Adjusted Gross Income: Gross income minus specific deductions.

Tax Bracket: The range of income taxed at a specific rate.

Exemption: An amount that reduces taxable income.

Dependent: A person, usually a child, who relies on someone else for financial support.

Payroll Tax Credit: A reduction in the amount of payroll tax owed.

FSA - Flexible Spending Account: Flexible Spending Accounts are a pre-taxed benefit offered to employees. Sometimes the employer will contribute a set amount to every employee regardless if they choose to participate. There are two forms of FSA's. There is the HFSA that allows employees to put money aside for insurance co-pays and over-the-counter medications and certain medical procedures not covered by insurance.

The second is the DFSA which is a pre-taxed way to pay for childcare expenses incurred, so the employee can work.

Holiday - Holiday Pay Or Holiday Account: Holiday can have two meanings. The most common is to signify that you were paid for time-off on a company designated holiday. If you are required to work on a holiday that most employees get off, the company may pay you double time. The other pat stub terminology that can fall under Holiday is to designate a special savings account, employees can utilize to put money aside for the holidays.

INS - Insurance: INS stands for health insurance deductions. You may also see additional pay stub abbreviations under this category. They include the types of insurance, i.e., HMO, PPO, Life, etc. Or it could be the abbreviations for the insurance carrier.

REG - Regular Pay: Regular pay is either the hourly wage an employee is paid or it's the per pay period salary of exempt employees. Additional codes in this category include, hourly, exempt, and nonexempt.

ST - State Taxes: Not every state has income-related taxes. If you live in a state with a state income tax, you will see this field. These taxes are calculated similarly to federal taxes.

Is Your Paycheck Adding Up?

Your pay stub abbreviations outline what everything associated with your paycheck means. This includes taxes and benefits deductions. If you need additional help understanding your paycheck, don't hesitate to speak with a payroll specialist where you're employed. If you're a business owner looking to automate the payroll process, Check our pay stub maker it is user-friendly and accurate. Click here to get in touch with one of our representatives. You should also know how to identify a fake paystub and what sort of information that's required on a paystub.

Our customer support is available 24/7:

Our customer support is available 24/7: