The Dos And Don'ts Of Using A Paystub Generator: Explained

There are more renters now than at any other time in United States history. At the same time, there are more freelancers now than at any other point in time. This means that for people who are self-employed proving income can seem like an impossible task. There are options like a signed employer letter but in many situations, this isn't enough proof.

Federal law states that employers don't necessarily have to provide paystubs so it can be nearly impossible to prove that you have a stable source of income. Luckily there are paystub generators that help you make convincing paystubs that will help you prove your income.

If you're looking for a way to pay your employees or apply for a loan then we have the perfect list of does and don'ts for using a paystub generator to create convincing paystubs.

1. Do: Proofread And Review The Paystub

The key to creating paystubs that will work as documentation is ensuring that the information is accurate. Your format and design have to be neat, professional as well as clear, and legible. Make sure that your pay stub maker has a calculator so that all the numbers add up correctly. The sloppier your work the harder it will be to approve your loan and the more unprofessional you'll end up looking as a result.

The numbers need to add up properly designs of each paystub should be consistent. The more accurate the paystub the easier it will be for your application to get approval.

2. Don't: Forget To Include Important Information

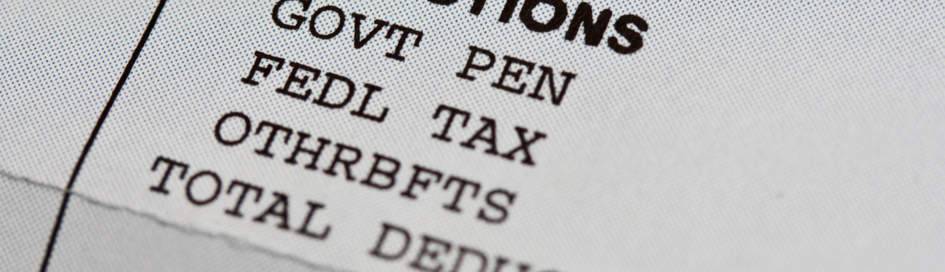

Making a pay stub can seem complicated to people who don't work in accounting or payroll. If you want to be sure that your paystub provides appropriate documentation then it needs to have a few things. The first thing your stub needs to include is gross pay. This refers to the full amount of money you make before anything is taken out like health insurance or taxes.

If you're a salaried employee to figure out the amount to put on each pay stub take your yearly salary and divide it by the number of pay periods you have during the year. To illustrate if you have $48,000 per year and you get paid each month your gross pay on the stub should read $4000. If you're an hourly employee then you need to multiply the amount you make per hour by the number of hours worked. Always make sure to stay on top of any tax updates that may occur in order to avoid unnecessary surprises.

3. Do: Make Sure The Dollar Amount Is Exact

To make your paystub convincing to people who are used to approving loan applications you need to be as clear as possible. Be sure to avoid things like estimates and rounding. If you plan on giving these to landlords or accountants then it may look bad if you use excessive rounding. This lead to a lack of professionalism and can cause legal issues.

Be sure and note that if you are unemployed and are making these paystubs with made up information then you are committing fraud. If the amount of money on the stubs is incorrect then this may cause you to be in legal trouble.

4. Don't: Use Free Paystub Generators

This may seem unfair but free printable check stub maker don't necessarily give you customizable options. This can make your paystub look unrealistic and unprofessional. Many of these use invalid data. While it may seem tempting to use free printable paycheck stubs we would resist the urge.

Though we advise against using a free pay stub generator if you're going to use one we advise using a free pay stub template with a calculator to ensure that all your numbers add up correctly.

5. Do: Use A Professional Program

If you want to use a professional program you need to know what to look for in a program. Check the formatting of the paystubs and ensure that they have headers and columns that their pay stub templates are consistent. Make sure that the site is reputable by reading numerous online reviews and checking the business's history.

The site's website should also be secure so that you know you aren't being scammed or giving your information out to people you can't trust. Verify that the company has good customer service that will answer any questions and help you navigate the software if you have any problems. All these steps are necessary if you want to avoid getting into any legal trouble for producing fraudulent paystubs.

6. Don't: Keep Paystubs On Hand Too Long

The Internal Revenue Service can usually only go back three years for an audit so be sure to keep your paystubs on hand for at least that long. Store all your paystubs in a locked box along with any other relevant data and discard them when they no longer become relevant.

7. Do: Know How To Safely Dispose Of Paystubs

One of the hardest things about making sensitive documents is knowing how to properly dispose of them. In fact, one of the easiest ways for identity thieves to get their hands on your personal information is by rummaging through your garbage. Be sure to shred these documents when you're done using them.

8. Don't: Use Them Only Once

Keep in mind that you'll most likely need paystubs for numerous things throughout the year including ensuring the accuracy of your W-2 during tax season. These also help in case of an emergency. If you need to apply for any kind of personal loan then having a paystub on hand may help you immediately get the loan you need.

Having a paystub on hand may give you peace of mind and help you keep track of your income more easily.

Need More Paystub Tips?

Now that you know the do's and don'ts of using a paystub generator want to learn more about how they can improve your business? If you're curious about how to generate your own paystub, get started now with the check stub maker today! Perhaps you might enjoy reading this article on what to focus on before making a career change.

Be sure to check out our other blog entries in the category of 1099 form and w2 form!

Our customer support is available 24/7:

Our customer support is available 24/7: