Do Employers Have To Provide Paper Pay Stubs? Here's What You Should Know

You might ask, "Do employers have to provide paper pay stubs?" Well, it goes beyond providing a direct answer. For one, it depends on the pay stub requirements and the laws involved.

Every employee has the right to ask for their pay stubs. It is, therefore, up to employers to follow the necessary regulations to know what actions to take.

This article covers the employee pay stub requirements at federal and state levels. You'll be able to understand what to do when you don't receive your pay stubs and the consequences of non-compliance.

Understanding What Pay Stubs Means

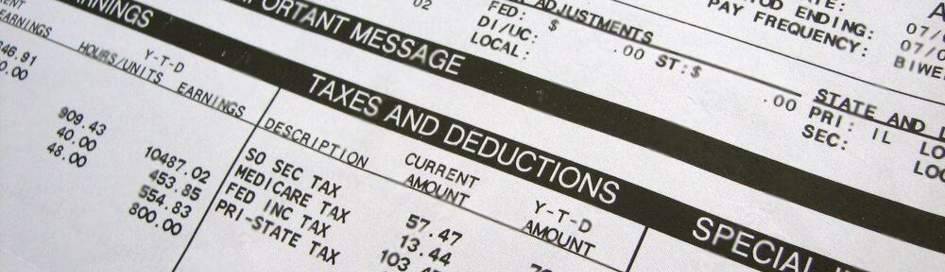

A pay stub is incredibly useful to employees and employers. It contains information regarding an employee's earnings, including wages, deductions and taxes withheld.

These are some of the information that is contained in a pay stub:

Employee personal details

Beginning and end dates of the pay period

Number of hours worked and types of hours worked, including regular, overtime, break time, double-time and many more.

Total gross earnings, which is the pay before deductions

Pay rate

Federal and State taxes withheld

Deductions, including Insurance, Medicare, Social Security

Contributions, such as to a retirement or pension plan

Wage garnishments, such as child support

Total deductions

Year-to-date payroll earnings

Net pay, which is the pay after deductions

Why Do You Need a Pay Stub?

A pay stub is more than a document that records your earnings; it also has other important functions. Pay stubs help you track your contributions and see your withheld taxes. Then, you can track and confirm that your pay matches the hours you worked. Pay stubs are also useful when reviewing tax filings or conducting personal audits.

Your pay stub helps you maintain financial transparency and accountability. It acts as proof of income when you apply for loans or mortgages. It’s also helpful for long-term financial choices.

Do Employers Have To Provide Paper Pay Stubs?

If you’re looking for the answer to “Do employers have to provide paper pay stubs?” well, the answer depends. This may vary depending on the pay stub requirement of the state where you work.

Federal and State Pay Stub Requirements

Are employers legally required to provide pay stubs? It really depends on state and federal laws. Under federal law, no direct federal law requires employers to issue pay stubs to their employees. The Fair Labor Standards Act (FLSA), however, requires employers to maintain employee payroll records. This involves keeping every employee's wages and hours worked.

It is a bit more complicated for state laws, as pay stub requirements vary from state to state. It is up to employers to understand and comply with the state pay stub requirements in which they work. If they have employees across different states, they must follow the pay stub requirements of each of their employee's states.

State-by-state pay stub requirements are divided into five categories:

Access States

In the access states, employers are required to give employees their pay stubs. They are allowed to view their pay stubs. While employers can still give their employees paper pay stubs, digital pay stubs are preferable. What matters is that employees should be able to access their pay stubs if needed.

Access states include:

Alaska

Arizona

Idaho

Illinois

Indiana

Kansas

Kentucky

Maryland

Michigan

Missouri

Montana

Nebraska

Nevada

New Hampshire

North Dakota

New Jersey

New York

Oklahoma

Pennsylvania

Rhode Island

South Carolina

Utah

Virginia

West Virginia

Wisconsin

Wyoming

Access/Print States

These states require that employees not only have access to their pay stubs but also be able to print them. In these states, physical pay stubs are essential for personal recordkeeping. Furthermore, employees must have access to electronic pay stubs and be able to print them.

These states include:

California

Colorado

Connecticut

Iowa

Maine

Massachusetts

New Mexico

North Carolina

Texas

Vermont

Washington

No Requirement States

These states do not have specific pay stub requirements. It does not require employers to issue pay stubs to their employees. It is typically up to them to provide pay stubs. Employers don’t have legal requirements for pay stubs. Still, they should keep them for employees. They should give pay stubs to employees upon request.

They include:

Alabama

Arkansas

Florida

Georgia

Louisiana

Mississippi

Ohio

South Dakota

Tennessee

Opt-Out States

These states require employers to allow employees to opt out of using digital pay stubs. This applies to cases where an employer switches to using electronic pay stubs. The employee can decide not to receive digital pay stubs and instead continue receiving their paper pay stub.

Opt-out states include:

Delaware

Minnesota

Oregon

Opt-In States

Hawaii is the only state that requires employers to ask for their employee's permission before they use digital pay stubs. How it works is that employers must give printed or physical pay stubs. This is until the employee agrees to receive their pay stub electronically.

Digital vs Paper Stubs

Employers can either use paper or digital pay stubs when issuing pay stubs. Paper pay stubs show an employee's total pay and deductions. It also includes your taxes and net take-home pay. Employers often hand out printed pay stubs to employees or mail them.

On the other hand, electronic pay stubs are pay stubs that employees can access online. Digital pay stubs have the same information as paper stubs. Employers often send digital pay stubs online. This makes them easy to access. You can access it from your phone, tablet or computer if you have an internet connection. You don't have to print it physically.

Digital pay stubs are better because they give employees quick and easy access to payroll info.

What To Do if You Do Not Receive Your Pay Stubs

There might be situations where your employer wouldn't give you pay stubs. If you find yourself in this situation, there are a few things you can do. Firstly, you can start by talking to your employer. Sometimes, your company may use a payroll system you don't know. There may also be an error or delay in issuing your pay stub. It is a good idea to clarify and talk to your employer before you assume.

Note that if you are in a state where you can access your pay stub, you have every right to ask for it. Check your state laws. To ask for this information, you can write a letter to your employer.

If your state allows you to access your pay stub, but you still don't get it, you should then take legal action. Your employer has refused to comply, so you can consult a labor attorney. You can also contact your state labor department to protect your rights.

Consequences of Non-Compliance for Employers

Depending on the state, the consequences for non-compliance differ. In California, employers have to give payroll records to employees within 21 days of their request. If they fail to do so, the employee is entitled to a $750 penalty. They can also seek damages of up to $4,000 if their employer doesn't follow the pay stub requirements.

This is why it is best to avoid non-compliance, as ignoring state pay stub requirements can lead to serious consequences. Even if pay stubs aren't required, let your employees access their pay info when they ask. This helps to build trust between employers and employees while avoiding legal issues.

In Summary

Meeting pay stub requirements is easy. It is advisable to do so duly to avoid fines and penalties. These are expenses that you can just avoid. While you do this, it is important to consider online pay stub generators to generate easy and accurate pay stubs. Digital pay stubs remove manual generation, which can be quite stressful to create.

You do not have to create manual pay stubs anymore. Our pay stub generator creates electronic pay stubs for employees. It simplifies this process for you while following your state requirements. Our automated tool gives and calculates accurate pay stubs, all within seconds! Get started with us today.

Our customer support is available 24/7:

Our customer support is available 24/7: