How To Read Pay Stub Codes And Abbreviations

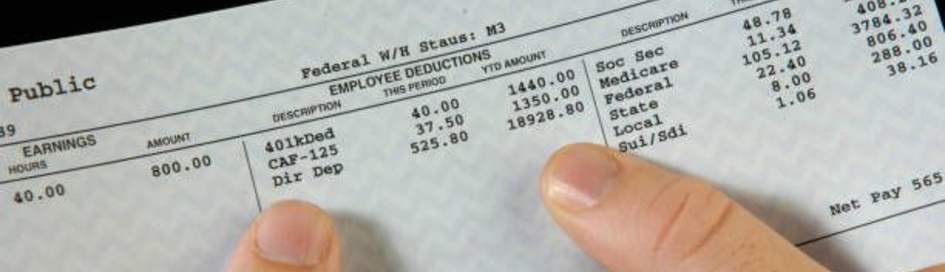

A pay stub has different types of information included in it. At times, the information listed on your paycheck stub is easy to understand at a glance. Looking closely enough, you will see some pay stub codes and abbreviations.

Understanding these details sometimes feels like cracking the code on a digital lock. Some people prefer to ignore these codes and stick to what they know.

You need these pay stub codes and abbreviations to understand your earnings. If you have ever wondered what those shorthand codes on your paycheck mean, this is for you.

Here, we will dive into the meaning of those pay stub codes and abbreviations you find on your pay stub. Ultimately, you will know exactly what every detail on your paycheck means and why it is there.

What Do Pay Stub Codes Mean?

Pay stub codes and abbreviations are shorthand word versions. They are used to depict your paycheck's specific details. They represent vital information in your pay statement. These payroll abbreviations help you understand your payroll statement at a glance. These codes were adopted to condense bulky data and information into bite-sized details. It makes it easier to understand the summary of your pay statement at a glance.

You can see what went in and what came out and an overview of your benefits, taxes, and deductions. They do more than act as placeholders for a summary. These codes help employers and employees track critical financial figures. These codes are common to most states and usually change at an international level. There are many of these codes, and each has its distinct meaning on your paycheck.

Common Pay Stub Codes and Abbreviations

Several pay stub codes and abbreviations have been adopted as standards across states. They appear on most pay stubs depending on the content requirements. The specific delivery of federal and state regulations can also affect it. While you might only see some codes on rare occasions, there are a few common ones. Here are some of the common pay stub codes you should know:

YTD: It means "year-to-date." it represents your total earnings from the start of the year up to the date of your current paycheck.

REG: It could mean regular hours or regular earnings. This code depicts the pay period based on the number of hours worked.

OVT or OT: This code indicates the number of overtime hours worked by an employee. Overtime hours have a specific pay range, usually policed by local or state laws.

GROSS: This is one of the most common pay stub codes most people know. It represents your total earnings before any deductions like taxes are made.

NET: This code is similar to GROSS, as it also depicts your total earnings. The primary difference is it shows your earnings after all deductions have been made.

TAX: Different types of tax are deducted from earnings and shown on the paycheck. These taxes further have categories with their own codes, such as FICA and FIT.

DED: This represents all deductions made to your account. It includes company policy fines, benefits, healthcare, etc.

These pay stub shortcodes and abbreviations are essential. They give you an overview of what goes on with your paycheck before it gets to you.

How To Read Pay Stub Abbreviations

Now that you know the common pay stub codes, the next step is to interpret them. These payroll abbreviations can seem complex initially. With time, it becomes easier once you cover the basics.

One thing about pay stub codes and abbreviations is you cannot just read them casually. There is a proper way to read payroll abbreviations. Here is a step-by-step approach to make it a lot more straightforward for you:

Start at The Top

Locate the header of your pay stub where you find your name. This header would have other details like employer name, employee ID, and period dates. This part gives you background info on the context for the rest of the details in your paycheck.

Check For Earnings Time:

From the header, you progress downward to the section with the hours worked and earnings. You usually see an abbreviation like "REG." It shows your standard regular work hours. Not too far from it, you see the "OT/OVT" payroll abbreviation that specifies overtime work hours. Next to the details, you will see your earnings for each one for that pay period.

Confirm Earnings Figures

The next thing to do is to confirm the details on the paycheck stub. Confirm the number of hours worked, overtime earnings, and total earnings. It is advisable to have personal records to check against. If your company has a self-service portal that helps you track your work hours, then you are good to go.

Confirm that the total earnings match the figures on your paycheck. You also want to confirm all deductions made to your total earnings. These include your taxes and insurance payments.

Review Your YTD

YTD shows the values for your total earnings from the start of the year to your current paycheck. Review all deductions made to your account. Consider taxes, benefit payments, and other deductions. This will give you a much better overview of your financial status and progress all year.

Why You Need To Understand Common Pay Stub Codes

There are several key benefits to identifying each payroll abbreviation and its meaning. Here are some of the reasons why you need to know what those shorthand codes on your pay stub mean:

Better Transparency

The bridge between the employee and employer relationship is transparency. When both sides are on the same page of the paycheck, there is improved trust. This then translates to a better working relationship. When both sides are satisfied with the financial status, business operations improve.

Better Record Keeping

These shorthand codes give both sides a clear summary of the key details of a pay stub. It makes record-keeping much easier with reduced pay stub bulkiness. Imagine if your paycheck stub had to explain every detail. No one wants to glance through multiple pages of a document, uncertain if they missed any detail. It also helps to maintain more accurate and consistent records for audits and tax filing.

Quicker Dispute Resolution

Employee disputes never mean well for a business. When an employee cannot understand their pay stub, they tend to trust it less. It increases the chances of employee-employer disputes. If not well handled, these disputes can blow up into lawsuits and other forms of legal action. These payroll abbreviations make it easier to track and correct potential errors.

Better Decision Making

The decision-making goes two ways as an advantage to both the employer and the employee. It helps the employee understand their current financial status. The information can also aid critical financial analyses and decisions. The employer can know at a glance the current state of their finances and where adjustments need to be made. Knowing the earnings and deductions can help employees negotiate better terms and benefits.

How To Get The Most Out Of Your Pay Stub

Now, you know the different pay stub codes and abbreviations and what they mean. The next step is to ensure you're getting the very best out of that deal. So, how do you make the most of your pay stub? Try these tips:

Ask Questions: If there is something you do not understand or some figures are not adding up. Reach out to your HR or payroll department for an explanation immediately.

Cross Check Regularly: Do not wait for potential errors to pile up before making a review. Make sure your earnings and deductions are in line with your financial goals for each pay cycle.

Stay Up to Date: Due to fast-changing regulations and policies, you need to stay up to date. This helps to ensure you are always informed on potential changes in your paycheck.

Final Thoughts

Both employers and employees benefit greatly from knowing what the codes on their pay stubs mean. These common pay stub codes and payroll abbreviations are not just fancy letters accompanying a paycheck. They bring better transparency and improved relationship between an employer and their employees. It not only builds trust but aids better financial planning on both sides.

Are you ready to transform your payroll processes? Try out Our Online Pay Stub Tool to create your pay stub seamlessly. Our platform gives helpful resources and tools to help you comprehend and minimize errors on your pay stub. Our customer support is available 24/7:

Our customer support is available 24/7: