How Much Do You Have To Make To File Taxes - The Full Guide

The amount of money you need to make in order to file your taxes is not as high as it used to be. In fact, the IRS has lowered the threshold for filing a tax return from $10,000 to $2,500.

The income limit for filing taxes was originally set at $10,000 in 1913 and then increased to $50,000 in 1918. It wasn’t until 1954 that the income limit was raised again to $100,000. Since then, the income limit has been adjusted several times but never decreased below $100,000.

If you earn less than this amount, you can still file a 1040EZ form with no penalties or interest charges. However, if you earn more than this amount, you will have to pay taxes on any excess earnings.

This means that if you earn between $2,500 and $10,000, you will owe taxes on any additional income over $2,500. For example, if you earned $5,000 in one year, you would only have to pay taxes on $2,500 ($5,000 minus $2,500).

If you earned $11,000 in one year, however, you would have to pay taxes on the remaining $9,000.

So with that in mind, let's take a look at filing taxes in more detail.

Also read: How Long To Keep Tax Returns

What is the Income Requirement For Filing Taxes?

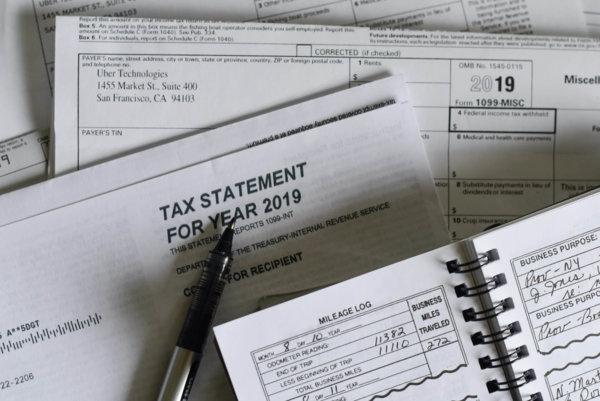

The income requirement for filing taxes is based on your Adjusted Gross Income (AGI) which is calculated by adding up all of your sources of income. This includes wages, salaries, tips, dividends, rents, royalties, alimony, child support, etc.

You also count any other income such as capital gains, pensions, Social Security benefits, unemployment insurance, disability payments, etc.

Once you add everything together, you get your AGI. If your AGI is greater than $100,000, you must file a regular federal income tax return.

However, if your AGI is less than $100,000 you can file an amended tax return. To do so, you must first complete Form 1040X, Amended U.S. Individual Income Tax Return.

When completing the form, you simply list all of your sources of taxable income and subtract them from your total income. Then you enter the difference on line 5 of the form.

For example, if you made $20,000 in wages and received $1,000 in rental income, your total income would be $21,000. Your AGI would be $21,001.

On line 6 of the form, you list all of your sources and subtract them from your AGI. So in this case, you would write down $20,000 for wages and $1,000 for rental income.

On line 7, you enter the difference between what you wrote on lines 5 and 6. So you would write down $21,001 – $20,000 + $1,001.

Finally, on line 8, you enter the number you entered on line 7. So you would write $1,001.00.

Now you are ready to submit your amended return.

Also read: What Happens If You Don’t File Taxes?

How Can I Get Help With My Taxes?

There are many ways you can get help with your taxes. Here are some of the most popular options:

Tax Preparation Software

Tax preparation software is a great way to file your taxes because it makes preparing your taxes easy and convenient. These programs allow you to prepare your returns online and even calculate estimated taxes.

They also provide step-by-step instructions to make sure you don't miss anything when filling out your forms.

The best part about using tax preparation software is that they usually come with free updates so you always know that your program is current and accurate.

Also read: Find Out If Political Donations Are Tax Deductible!

Free Online Services

Another option is to use free online services like H&R Block or TurboTax. Both offer free versions of their products as well as paid versions.

With these sites, you can easily fill out your own forms without having to worry about missing something. Plus, both companies will walk you through every step of the process.

If you decide to go with either company, keep in mind that you may need to set up an account before you can start using the service.

H&R Block offers two different types of accounts. The Basic Account allows you to file only one return per year and has a limit on how much you can earn each year.

The Premium Account allows you to file multiple returns at once but has no limits on how much you can make.

TurboTax offers three different plans. All have limits on how much you make each year and the amount of time you can spend filing your return.

The Free Edition includes basic features like estimating your taxes and calculating your refund. It's available for free if you meet certain requirements.

The Premier Edition comes with more advanced features such as itemizing deductions and claiming business expenses.

Also read: Ever Wondered If Medical Expenses Are Tax Deductible?

Does Age Affect Filing Taxes?

Yes, age does play a role in whether you should file your taxes early or late. For example, if you're 65 years old or older, you generally must file by April 15th. If you're younger than 65, then you typically have until October 15th to file.

However, there are exceptions to this rule. For example, if your birthday falls during any month other than January, February, March, April, May, June, July, August, September, or October, then you can file your taxes anytime after December 31st.

If you turn 70 1/2 years old before April 15th, then you'll be able to take advantage of the "Age 50" extension. This means you can file your taxes as early as April 30th. However, if you wait until April 30th to do so, then you won't qualify for the extension.

Also read: How Much Do You Understand Tax On Bonuses?

Final Thoughts

How much you earn can affect when you need to start filing taxes. But, if you want to get started right away, then you might consider using tax preparation software.

These programs can help you complete all of your forms quickly and accurately. They also include helpful tips to ensure you don't miss anything.

And since most of them come with free updates, you never have to worry about getting behind on your taxes.

Taxes show up on your pay stubs so make sure that you check your pay stubs regularly and ensure you are paying the right taxes.

Our customer support is available 24/7:

Our customer support is available 24/7: