Breaking Down Your Pay Stub Deduction Codes

When was the last time you paid attention to pay stub deduction codes? Chances are, it was a while ago. With 96% of American employees getting paid via direct deposit, most people just pay attention to the number that's put in their checking account.

There was a major tax bill passed at the end of 2017 and the IRS changed its withholding tables, changing the amount of money that's taken out of your check.

The IRS wants to make sure that you're withholding the right amount of money from your paycheck. Not withholding enough could leave you with a huge tax bill in April.

You'll need to check your pay stub and decipher those codes. What do those codes really mean? Keep reading to find out.

Most Common Pay Stub Deduction Codes

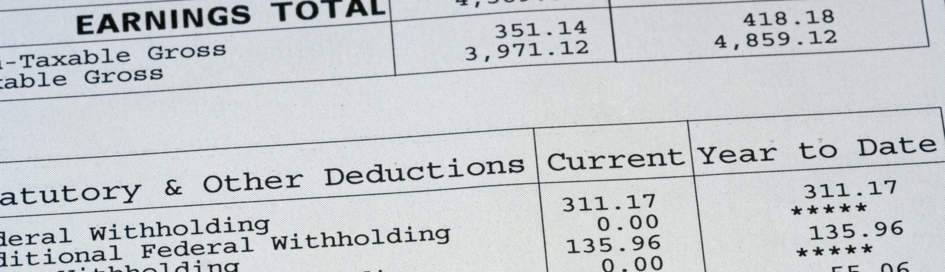

When you look at your pay stub, you'll generally see what you earned, what your take-home pay was along with several lines of deductions. These are the most common ones.

Gross Pay: This is the amount of money earned during the pay period.

FED: It could also be FIT or FITW. They all mean the same thing. Federal Income Tax Withheld.

STATE: SIT or SITW. This is an important one to look at, especially if you're a remote worker in a different state than your company. Make sure that the state is correct. Otherwise, you could be in for a huge state tax bill.

OASDI: This could be listed as FICA, SS or SOCSEC. This is the amount of social security tax that's taken out of our check. This should be 6.2%. Your employer covers 6.2%, too, making your total contribution 12.4%.

Note that if you're self-employed or an independent contractor, you're responsible for paying the entire 12.4% yourself.

MED: This is the Medicare tax, which is 1.45%. Your employer covers the other 1.45% that goes to the government.

FSA or HSA: These refer to Flexible Spending Account and Health Savings Account.

401(k): This will note how much you're putting into your company's retirement account.

Net Pay: This is the final amount, after deductions. This is what will be deposited into your checking account.

Once you are able to decode your paycheck, you can then take the appropriate steps to make sure the right amount of money is withheld from your check. You may see an initial bump in your net earnings, but you need to make sure that's not at the expense of underpaying your taxes. That could possibly lead to penalties.

Check Your Pay Stub

There are many reasons why you need your pay stubs. If you need them to show proof of earnings to apply for an apartment or mortgage, you should understand what the pay stub deduction codes mean. If you're still confused and wondering what is the difference between a salary vs hourly paystub, check out this guide.

With direct deposit making life easier for you to get your earnings, you still have to be financially responsible and know what the deduction codes mean. Otherwise, you could be in for a lot of headaches down the road.

If you're looking for easy-to-read paystubs, use the paystub creator to create your own paystubs now!

Our customer support is available 24/7:

Our customer support is available 24/7: