State Laws Pay Stub Requirements: What You Should Know

The world of payroll involves a significant number of paperwork and documentation. Sometimes, getting around these can be tricky. This is especially true when this paperwork cuts across different states.

Understanding state laws pay stub requirements is non-negotiable. Even though getting around it might seem a bit overwhelming.

Are you an employer trying to comply with the laws or an employee looking to know and understand your rights? Here is a helpful all-in-one guide covering all you need to know about state-specific payroll laws in 2025.

We’d take it a step further with a pay stub rules by state guide to help you get familiar with all the essential details you need.

What Does “State Laws Pay Stub Requirements” Mean?

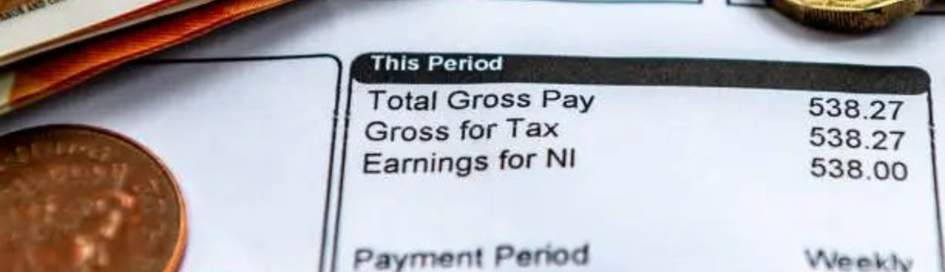

To put it plainly, a pay stub is simply a wage statement. It is a breakdown of an employee’s earnings, including all deductions, the net pay, and the specified engagement timeframe. In other words, a pay stub is also known as a pay slip and is critical for effective record keeping, both for the employee and the employer.

Now, it is essential to note that different states have their own laws and requirements. These guide and dictate both the format and delivery of pay stubs. These laws also determine the content of the pay stub, what is included, and what is not. They typically differ from state to state. Different state laws have specific state requirements for pay stubs. While most rules might be similar across states, there are slight yet significant differences.

For example, some states, like Alabama, have no specific requirements guiding pay stubs. However, other states like Idaho and Illinois allow pay stub delivery in any format. We also have states like North Carolina and Texas that require pay stubs to be delivered in written or printed format only. These requirements can also impact the information on the pay stub, depending on the laws of that specific state.

Pay Stub Rules By State

Here is a breakdown of the pay stub rules by state requirements grouped in categories based on the mode of delivery.

States With Written or Printed Pay Stub Format Only

Pay stubs in these states are either delivered in writing or printed in formats only to employees.

California

Colorado

Connecticut

Iowa

Maine

Massachusetts

New Mexico

North Carolina

Texas

Vermont

Washington

States With Pay Stub Delivery Options

These states allow employers and employees to choose their preferred pay stub delivery option. They are allowed to opt in or out of any option as they wish.

Alaska

Arizona

Idaho

Illinois

Indiana

Kansas

Kentucky

Maryland

Michigan

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New York

North Dakota

Oklahoma

Pennsylvania

Rhode Island

South Carolina

Utah

Virginia

West Virginia

Wisconsin

Wyoming

States With No Pay Stub Requirements

For states in this category, there is no legal obligation on the employer’s part to provide pay stub to employees.

Alabama

Arkansas

Mississippi

Florida

Georgia

Ohio

Louisiana

South Dakota

Tennessee

States With Employee Pay Stub Preference Requirements

In these states, employers are allowed to deliver pay stubs electronically. However, employees can opt out of the electronic option and opt in for paper stubs as their preferred option.

Delaware

Minnesota

Oregon

Hawaii (Employers can only deliver an electronic pay stub if the employee consents to it. If not, a paper stub is required.)

Pay Stub Information and Content Requirements

The pay stub mode of delivery is important to employees and employers. However, that is not the only core detail considered in state-to-state pay stub processes. Another thing to consider is the content of the pay stub. More specifically, the information included in the wage statement. While there is a standard required, several states have non-negotiable specific information.

Let us consider some common pay stub information requirements in different states.

Employer Information: In states like Maryland, the employer’s details are required on the pay stub regardless of the format. The details include the employer’s legal name, company/business name, address, and contact number.

Employee Information: Including the details of the employee is a requirement for most states. California, for example, requires the employee's legal name and the last four digits of their Social Security number.

Pay Period: The start and end dates of engagement are called the pay period. In some states, employers are required to list the total number of hours worked by the employee.

Pay Rates: It complements the pay period by specifying the hourly rates and must align with the information in the “pay period” section.

Overtime: This option is not always included for many states. It covers extra hours worked by an employee and the overtime pay rate.

Gross Pay: The sum of all payments before the deductions are made.

Deductions: Every deduction made by the employer from the employee's pay. These include federal and state law taxes, health insurance premiums, and many more.

Net Pay: The net pay is the amount left with the employee after all necessary deductions have been made from the total gross.

Sick Leave: Some states, like California, require an indication of the amount of sick leave available to an employee on the pay stub.

Pay stub requirements have state laws that specify the information to be included and how it is presented. All copies of these pay stubs are to be kept in proper records by the employers for at least three years. This is regardless of the current employment status of the employee. These details help transparency between employees and employers. It clarifies details on their earnings, including deductions and pay rates.

Consequences of Non-Compliance With Pay Stub Requirements

State-specific payroll laws are put in place to protect the rights of both employees and employers. They can also function on occasion as a source of information or evidence. This includes cases of legal issues between the employee and the employer. Most states do not take the default of these laws lightly, and defaulting can attract penalties and fines.

Financial Penalties: When you default on a state law for a pay stub, you can end up paying a fine as high as $50 per employee. This cost can double if you are a consistent violator. There have been occasions of fines as high as $4,000.

Legal Sanctions: When you fail to comply with state laws, you can get legal sanctions and class actions placed on you or your business. This will affect both your reputation and finances.

Best Practices To Ensure Compliance With Pay Stub State Laws

Now, you know how important the pay stub rules by state are. The next step is to make sure you are on the right side of the law. Here are three ways to do that:

Have a Standardized Process: A standard, consistent process reduces the risk of slipping off on some of these regulations. It would require good knowledge of pay stubs, their requirements, and how they are processed across states.

Use a Pay Stub Template: Keeping up is more difficult for businesses with multiple locations. The more employees, the harder it is to meet the pay stub requirements. A pay stub template is an effective management option for employers and employees.

Review and Revise: Pay stub rules by state change from time to time. Consistent review and revision of your processes by the state laws will help you stay on guard.

Final Thoughts

As an employer, you must understand pay stubs, how they work, and their processes across different states. With this all-in-one guide, you now know what state laws pay stub requirements are and how they differ across each state. This will help you process your pay stub document accurately and in compliance with the respective state laws.

Achieve pay stub compliance and accuracy with our pay stub generator. Our platform helps you generate pay stubs in literal minutes, saving you time and resources. It also provides a good range of pay stub templates to help you get started. Give it a try today!

Our customer support is available 24/7:

Our customer support is available 24/7: